Best Practices in Managing Cash Flow in Your Cleaning Business

Wed, Nov 27, 2024

Read in 8 minutes

To run a successful cleaning service business, you need to understand financial management. The first thing you need to do is maintain a healthy cash flow. Follow these tips to learn how.

Cash flow is one of the most important aspects of running any cleaning service business. And managing it properly is crucial for long-term success. In the cleaning industry, where businesses often deal with fluctuating income, managing cash flow effectively can make or break your company. Having a solid plan in place to handle the money coming in and going out ensures that your business can pay its bills, grow, and continue to serve customers.

Understanding Cash Flow in the Cleaning Industry

Before diving into the best practices for managing cash flow, it’s important to first understand what cash flow is and why it’s so critical to your business.

Cash flow refers to the movement of money into and out of your business. For a cleaning business, this includes the payments you receive from clients for cleaning services and the money you spend on supplies, labor, and overhead costs. A positive cash flow means you have more money coming in than going out, while a negative cash flow indicates that you may struggle to pay your bills or invest in growing your business.

In the cleaning industry, cash flow can be tricky due to inconsistent revenue. Especially if you have seasonal fluctuations or clients that pay on net-30 or net-60 terms. That’s why managing cash flow is so important – it helps ensure you have enough money to cover your expenses and avoid financial stress.

The Role of Coaching and Mentorship

A key element of managing your cleaning business effectively is having guidance along the way. Coaching and mentorship can be game-changers for business owners. With the right advice, you can avoid common pitfalls and gain insights into financial strategies that might otherwise be overlooked.

Mentors and coaches can help you:

- Improve your financial literacy and understanding of cash flow.

- Learn from the experiences of others who have successfully navigated the challenges of the cleaning industry.

- Provide practical tips on cost management, invoicing, and other important aspects of business.

By seeking mentorship, you’ll be more equipped to handle tough financial situations and grow your cleaning business in a sustainable way.

Ways to Manage Cash Flow in Your Cleaning Business

Now that we have a good understanding of cash flow, let’s explore specific strategies you can use to manage cash flow more effectively in your cleaning company. These best practices will help you keep track of your money, avoid common cash flow mistakes, and keep your business on solid financial ground.

1. Develop a Financial Management Mindset

The first step in managing cash flow is adopting a financial management mindset. This means taking an approach to tracking your business’s finances and being aware of how money flows through your cleaning business.

It’s easy to focus on just cleaning homes or offices and forget about the financial side of the business. But keeping a close eye on cash flow will ensure your business remains profitable. Start by setting aside time each week to review your business’s financial situation. Use accounting software or spreadsheets to track your income and expenses, and make it a habit to monitor your cash flow regularly. Especially if you are running professional cleaning services.

2. Set Clear Financial Goals

Setting clear financial goals is another important step in managing cash flow. Having goals will give you a direction to follow and help you track progress over time. For example, your financial goals could include:

- Increasing monthly revenue by 10%.

- Reducing expenses by 5%.

- Maintaining a positive cash flow by staying on top of collections and invoices.

Once you’ve set your goals, break them down into smaller, actionable steps that will keep your business on track. This helps ensure that you’re not just thinking about money, but actively working toward improving your financial situation.

3. Implement Efficient Invoicing Systems

A common cash flow problem for many cleaning businesses is delayed payments. Late or missed payments can cause cash flow problems, as you may not have the funds you need to cover bills and pay employees.

To avoid this, it’s important to have an efficient invoicing system in place. Here are some tips:

- Create clear, detailed invoices: Include all necessary details such as the services provided, date of service, total amount, and payment terms.

- Send invoices promptly: Don’t wait until the end of the month. Send invoices as soon as a job is completed to speed up the collection process.

- Follow up on overdue invoices: Send polite reminders for overdue payments. In some cases, offering early-payment discounts can encourage clients to pay on time.

By streamlining your invoicing system, you’ll be able to collect payments faster and keep your cash flow healthy.

Need some tips on how to make invoices? Click here for some tips.

4. Accurate Budgeting

Accurate budgeting is another key practice in managing cash flow. A budget helps you forecast your business’s income and expenses, allowing you to plan ahead and avoid any financial surprises.

When creating your budget, be sure to include:

- Fixed costs: These are ongoing expenses such as rent, utilities, insurance, and salaries.

- Variable costs: These fluctuate depending on the volume of business, such as cleaning supplies, equipment, and subcontractor fees.

- Savings: Set aside a portion of your income for emergencies, growth, or reinvestment in your business.

Having a clear and realistic budget will allow you to better manage your cash flow, making it easier to predict when cash will be tight and when you can invest in new opportunities.

5. Negotiate Favorable Payment Terms

Negotiating favorable payment terms with clients and suppliers can help improve cash flow. For example, many cleaning businesses operate on net-30 or net-60 payment terms. Which means clients have 30 or 60 days to pay for services rendered. However, these long payment terms can cause delays in your cash flow.

Here are some tips to negotiate better payment terms:

- Request shorter payment terms: If possible, try to negotiate for net-15 or even net-7 terms to receive payment faster.

- Offer early payment incentives: Encourage clients to pay earlier by offering a small discount for early payments.

- Consider payment upfront: For certain jobs, especially one-time cleanings, request partial or full payment upfront.

Negotiating better payment terms can make a significant difference in how quickly you receive payment and help you manage cash flow more effectively.

6. Diversify Your Services

Another way to improve cash flow is by diversifying the services you offer. By providing a range of services, you can attract a wider customer base and create more income streams. For example, in addition to regular cleaning, you could offer services such as carpet cleaning, window washing, or deep cleaning.

Having multiple service offerings helps ensure that your business remains steady even during slow periods. It also allows you to increase revenue from existing clients by offering additional services.

7. Implement Cash Flow Forecasting

Cash flow forecasting is the practice of predicting your future cash inflows and outflows. By forecasting cash flow, you can plan ahead for periods when cash may be tight and make adjustments before issues arise. It’s important to regularly update your forecast to account for changes in income and expenses in your cleaning company.

When forecasting cash flow, consider:

- Upcoming cleaning contracts.

- Seasonal changes in demand.

- Changes in supplier costs or equipment expenses.

A cash flow forecast gives you a clearer picture of your financial future and helps you make better business decisions.

8. Build Strong Relationships with Suppliers

Building strong relationships with suppliers is an essential part of managing cash flow. Suppliers can be flexible with payment terms, offer discounts for bulk purchases, or provide payment extensions during slow periods.

To build good relationships with suppliers:

- Communicate regularly: Keep an open line of communication with suppliers. So you can stay updated on any changes in prices or delivery schedules.

- Pay on time: Paying suppliers on time builds trust and shows you’re a reliable customer.

- Negotiate better terms: Don’t hesitate to negotiate better payment terms, such as extended payment periods or discounts for early payments.

Strong relationships with suppliers ensure that you have the resources you need to run your business without facing cash flow issues.

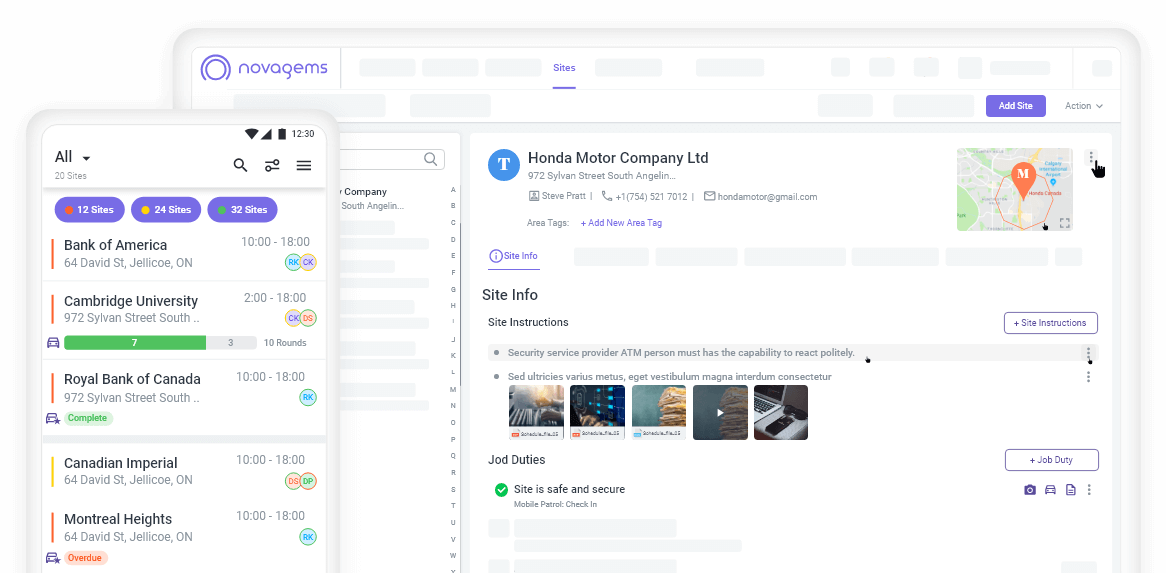

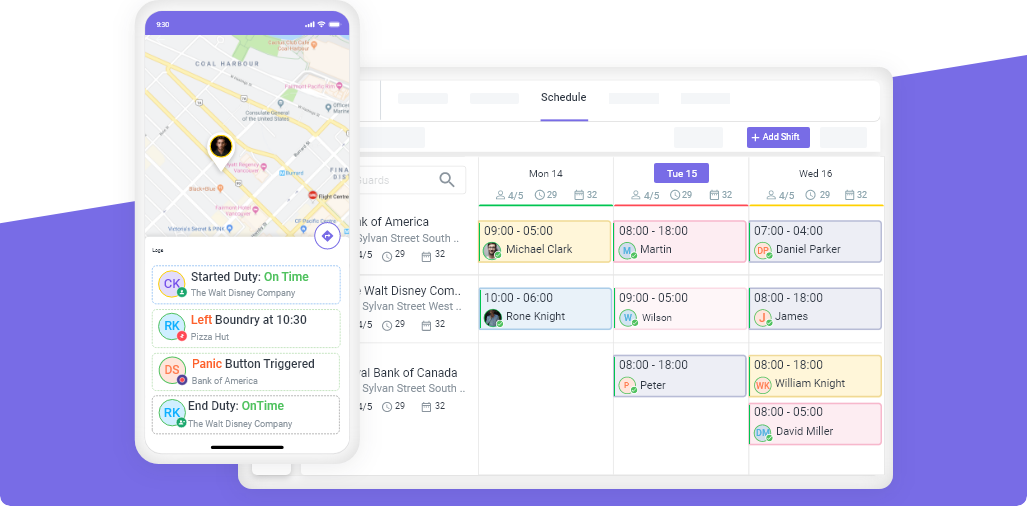

9. Leverage Technology for Financial Management

Technology can play a big role in improving your cash flow management. There are many software tools available that help you track expenses, create invoices, manage payroll, and forecast cash flow. Even if you have just started your cleaning company. Having such software is an investment.

Some tools you can use include:

- Accounting software help you manage your financials and track income and expenses.

- Scheduling software to help streamline operations and reduce inefficiencies.

- Payment processing platforms like Stripe or PayPal for quicker and secure payments.

By leveraging technology, you can make cash flow management more efficient and reduce the chances of financial errors.

10. Monitor Key Performance Indicators (KPIs)

Tracking KPIs helps you measure the financial health of your business. Some important KPIs for cash flow management include:

- Accounts receivable turnover: How quickly you collect payments.

- Gross profit margin: How much profit you make after covering the cost of goods sold.

- Operating cash flow: How much cash your business generates from operations.

By regularly monitoring these KPIs, you can stay on top of your business’s financial performance and take action when necessary to improve cash flow.

Conclusion

Managing cash flow effectively is key to the success of your cleaning business. By adopting best practices like developing a financial management mindset, setting clear financial goals, and implementing efficient invoicing and payment systems, you can ensure that your business stays financially healthy. Additionally, using technology and building strong relationships with suppliers can streamline your cash flow management. With these strategies in place, you’ll be able to manage cash flow with confidence and focus on growing your business.

Get a Free Trial

Sign up For Newsletter

Latest Blog Posts

Get Started

Start being productive & grow your business

with Novagems