What’s The Difference Between Double Time, Overtime, And Time And A Half

Tue, Sep 30, 2025

Read in 7 minutes

Know what’s the difference between double time, overtime and time and a half and save from company from any work laws that might harm your reputation. Save money and pay your employees fairly at the same time.

Key Takeaways

- Overtime is the additional income workers receive when they work more than regular hours (typically after 40 hours a week in the US, under the Fair Labor Act).

- Time and a half is the most prevalent overtime wage, compensating workers 1.5 times their regular hourly rate.

- Double time is when workers get 2 times their regular hourly rate, typically for holidays or extremely lengthy shifts.

- It is difficult to calculate overtime accurately because of varying state/provincial work laws, holiday regulations, and human errors.

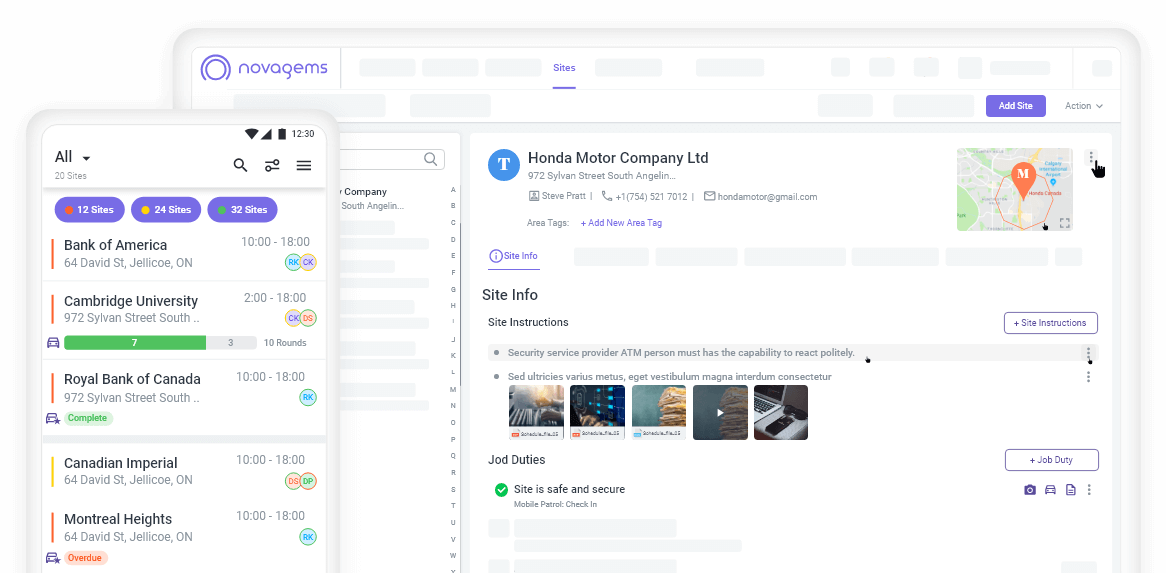

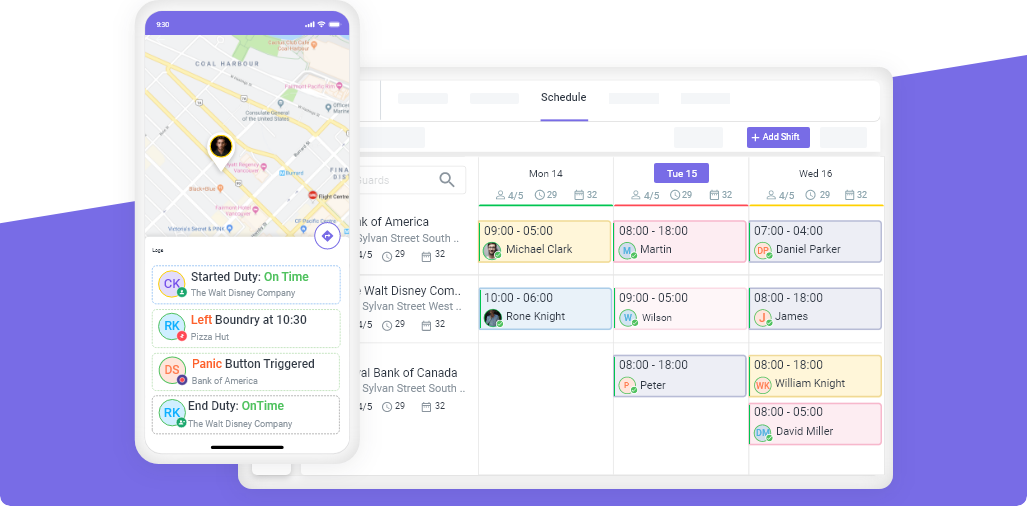

- Novagems workforce management software assists companies in monitoring hours.

One of the greatest challenges for companies that having hourly employees. Particularly in service-based industries such as security, hospitality, construction, and retail, is managing labor expense. Employees will frequently work nonscheduled hours, overtime, or fill in for absent coworkers, rendering payroll more complex than it appears.

The words overtime, time and a half, and double time are used routinely in scheduling and payroll discussions, but most managers do not know the subtle differences. One little error can run into hundreds, or even thousands, in unintended payroll costs.

This manual will define these words in simple language, provide you with examples, describe the frequent pitfalls, and illustrate how software such as Novagems simplifies labor cost control more than ever before.

What is Double Time?

Double time is when workers receive two times their regular hourly rate. It’s not as frequent as overtime or time and a half, but when it does occur, its effect on payroll can be huge.

Double time typically kicks in during circumstances like:

- Working on holidays (like Christmas Day, Independence Day, Canada Day)

- Longer-than-usual shifts (like over 12 hours in one day, depending on state/province regulations and work laws)

- Union contracts requiring double pay for specific hours or conditions

Example: If the guard makes $20 an hour under regular conditions, double time pays $40 an hour.

Routine 8-hour shift = $160

8 hours of double time = $320

One day of double time doubles payroll expense for that employee.

Why it matters: Double time guarantees workers are paid reasonably for doing work under challenging or unusual conditions. But employers must plan ahead to prevent unexpected jumps in payroll costs. A salary calculator can help estimate these costs in advance.

What is Overtime?

Overtime is any work done over the regular number of hours as specified by law or rule.

In the United States:

Federal law (Fair Labor Act) considers overtime to be more than 40 hours a week. Some states, such as California, also have daily overtime policies (after 8 hours/day).

In Canada:

Overtime limits depend on the province. For instance:

Ontario = 44 hours/week

British Columbia = 40 hours/week

The majority of employers pay time and a half for overtime, but some legislation and agreements call for double time in some cases.

Example:

Regular rate = $20/hour

Overtime rate (time and a half) = $30/hour

A 50-hour workweek (10 overtime hours) = $300 in overtime pay

Overtime is the most prevalent form of premium pay, and companies have to have solid systems in place to manage it accurately.

Why it matters: Overtime shields workers from being overly worked and not compensated adequately, yet it can readily consume profits if not carefully regulated. Many businesses rely on a salary calculator, but automated tools give more reliable results.

What is Time and a Half?

Time and a half is the most prevalent overtime pay. It refers to workers receiving 1.5 times their regular hourly pay for every overtime hour they work.

It most often comes into play when:

- Workers labor more than 40 hours per week (or province/state boundary under local work laws)

- Workers work on specific company-endorsed holidays (where double time does not apply)

- Workers are under collective agreements that require 1.5x compensation

Example:

Regular compensation: $20/hour

Time and a half compensation: $30/hour

5 overtime hours = $150 extra on top of regular pay

For businesses with hourly employees, time and a half is the default overtime rate that managers must monitor.

Why it matters: While not as costly as double time, time and a half still increases labor costs by 50% per overtime hour. Mismanaging it across multiple employees adds up fast.

Common Challenges for Calculating Overtime and Time and a Half

On paper, these pay regulations appear straightforward. But in practice, many businesses find themselves struggling to implement them properly.

Below are the most frequent issues:

Various Laws by Region

US: Federal = 40-hour rule under the Fair Labor Act, but states like California add daily overtime/double time.

Canada: Province-by-province regulation (Ontario = 44 hours, BC = 40 hours).

Holiday Pay Confusion

There are employers who pay time and a half during holidays and double time. Without policies, payroll mistakes are normal.

Manual Calculations

Relying on Excel sheets or handwriting logbooks can lead to errors. Even a small mistake can initiate payroll disputes. Businesses using a salary calculator still face errors if hours are entered incorrectly.

Unclear Employee Policies

Employees are not clearly informed about overtime or double time, resulting in confusion and mistrust.

Surprise Payroll Expenses

Scheduling overtime without understanding the true financial effect can drive weekly payroll expenses through the roof.

The U.S. Department of Labor says 1 in every 5 payroll has errors, frequently because of inadequate overtime tracking. The issue isn’t a matter of knowing definitions; it’s using them correctly in real-world scheduling.

Intelligent Labor Cost Control with Novagems

This is where Novagems’ workforce management software restores control for businesses. Built for businesses with complex scheduling (such as security), Novagems sees that you pay correctly, remain compliant, and stop unnecessary costs.

Here’s how Novagems works:

-

Time Tracking with Precision

Guards clock in and out through the mobile app, providing managers with real-time information about hours worked.

-

Automatic Overtime & Double Time Calculations

The system enforces the right laws according to your location and company policy. No more guessing games by hand or depending on a basic salary calculator.

-

Real-Time Alerts

Managers are alerted when an employee is going to reach overtime. This prevents last-minute surprises that cost money.

-

Seamless Scheduling & Payroll Integration

Scheduling and payroll integrate seamlessly, minimizing admin errors and conflicts.

Outcome: Businesses utilizing Novagems have reported savings of as much as 20% on payroll expenses and minimizing compliance risk.

Rather than responding to payroll issues, Novagems enables you to anticipate them.

Final Thoughts

Knowing the distinction between overtime, time and a half, and double time isn’t merely an HR technicality. It impacts your bottom line directly.

Overtime = additional hours worked over standard levels (Fair Labor Act and local work laws apply).

Time and a half = 1.5x pay (most prevalent overtime rate).

Double time = 2x pay (holidays or exceptional situations).

For workers, these standards guarantee equitable pay. For business owners, these are actual expenses that must be managed diligently. If you’re still manually tracking hours or using an outdated salary calculator, you’re taking a risk with payroll mistakes, compliance trouble, and wasted spending.

Ready to make payroll and scheduling easier? Schedule a demo with Novagems today and discover how smarter scheduling can revolutionize your business.

Double Time vs. Overtime FAQs

Q1. What is the distinction between double time and overtime?

Overtime typically refers to time and a half (1.5x) pay for hours over the regular workweek under the Fair Labor Act. Double time refers to 2x the base hourly rate, usually for holidays or really long shifts.

Q2. Is time and a half the equivalent of overtime?

Yes, for the most part. Overtime is generally paid at time and a half except where work laws, agreements, or company policy calls for double time.

Q3. Who are eligible for overtime pay?

Hourly and non-exempt workers are eligible under the Fair Labor Act. Exempt salaried workers (such as certain managers) usually are not.

Q4. When does double time need to be paid?

Double time does not need to be paid according to federal law but can be mandated by state/provincial work laws (e.g., California) or company rules (such as holidays).

Q5. How can employers minimize overtime expenses?

By utilizing scheduling software such as Novagems instead of only relying on a salary calculator, to record hours in real time, prevent unnecessary overtime, and issue reminders prior to employees reaching thresholds.

Get a Free Trial

Sign up For Newsletter

Latest Blog Posts

Get Started

Start being productive & grow your business

with Novagems